Tokenomics

This section outlines the economics of SWX tokens and their dynamic interactions within the protocol.

The tokenomics design is open to community suggestions and input. If you have any ideas or feedback, feel free to Edit this pages, and open a Pull Request on the swaptoshi-docs repository.

Initial Price

The initial price of the SWX token is set at 3.5 KLY/SWX. This pricing strategy is carefully designed to balance validator incentives with the overall market cap. Here’s a more detailed explanation:

-

Validator Incentive: The KLY network rewards

2 KLYper block with a7-secondblock time, resulting in approximately24,685 KLYmined daily by 53 validators. For Swaptoshi,0.25 SWXper block with a3-secondblock time yields about7,200 SWXper day. At a price of3.5 KLY/SWX, validators could earn around25,200 KLYdaily (before distribution among 23 validators), closely matching the KLY daily reward. -

Reasonable Initial Market Cap: In the first year, with

0.25 SWXper block, a3-secondblock time, and1,193.64 SWXpre-minted, the total supply will reach2,629,193.64 SWX. At a price of3.5 KLY/SWX, this results in a value of9,202,177.74 KLY, which is approximately5%of the KLY market cap. -

Encourage Growth: Setting the price at

3.5 KLY/SWXmakes it accessible for newcomers to join the network. Increased participation can drive up sustainable demand, which in turn can boost the token’s value.

Again, if you have any ideas or feedback about the initial price, feel free to Edit this pages.

Allocation & Distribution

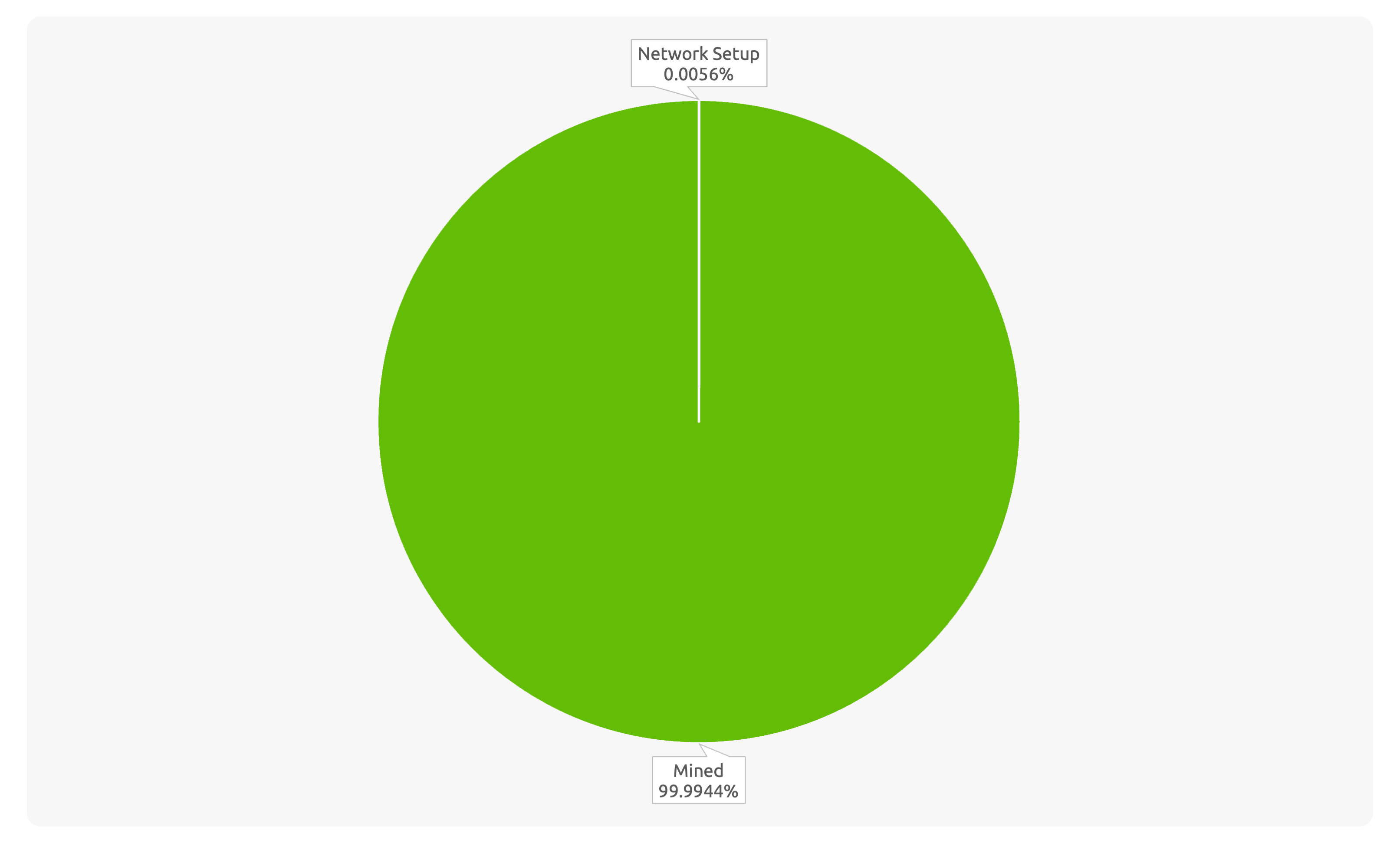

SWX token is introduced as a fair-launched token, designed as a deflationary token with a fixed total supply of 21,000,000 coins.

At launch, 119,364,000,000 Nakamoto, equivalent to 1,193.64 SWX or 0.0056% of the total supply, will be minted for network setup purposes. The remaining 20,998,806.36 SWX, or 99.9944% of the total supply, will be mined over a period of 100 years.

The pre-minted 740.64 SWX tokens will be held at the address klyof58j7a5fvs55utdnv6xmkv3b6swjmjaotbt85. Meanwhile, at genesis block, 143 SWX will be distributed to 13 genesis validator, and 310 SWX will be distributed to 10 VIP Validators.

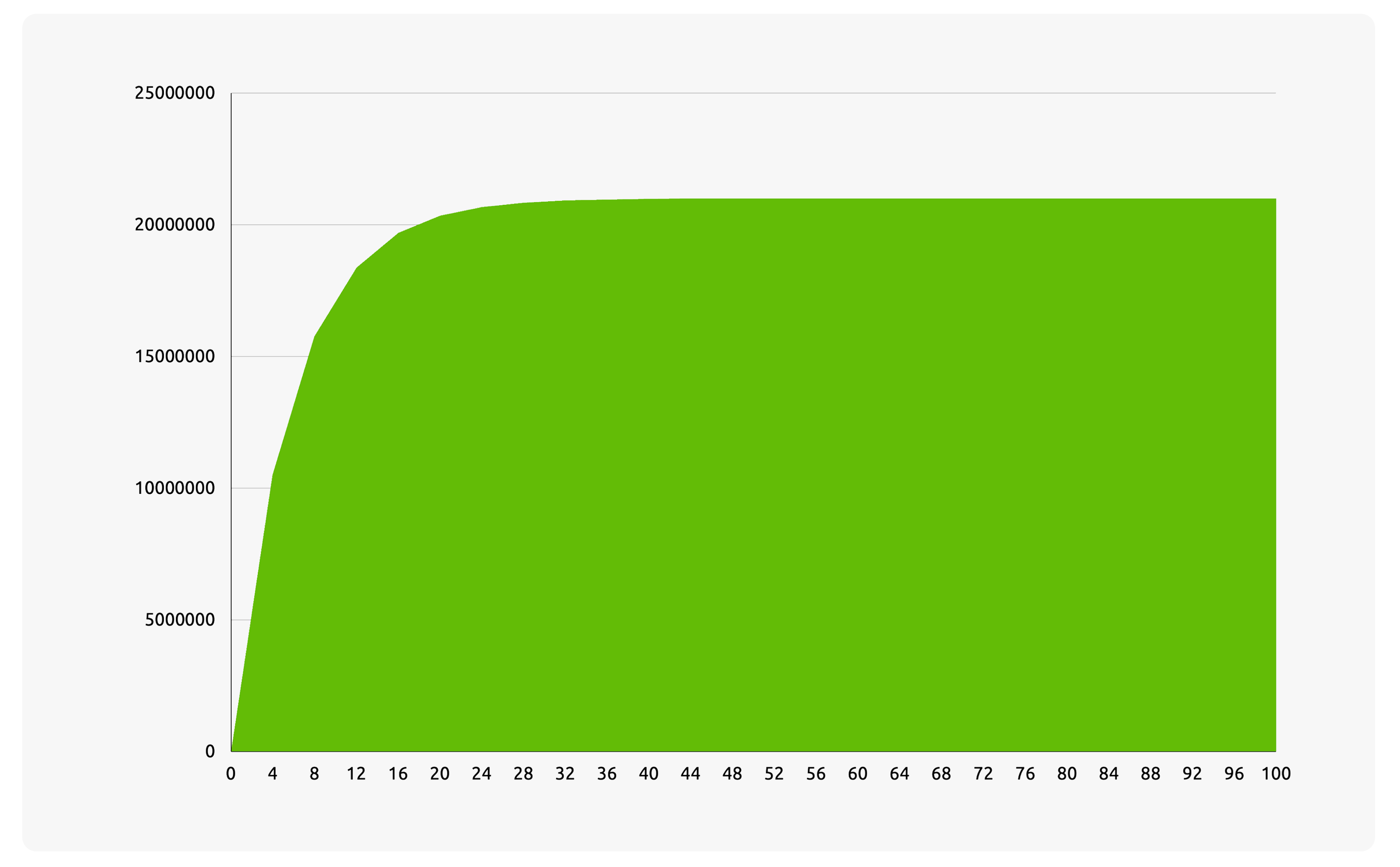

Below is the table showing the SWX block reward over time.

| Year | Block Reward | Total Supply |

|---|---|---|

| Preminted | 0 | 1,193.64 |

| 0-4 | 0.25 | 10,501,193.64 |

| 4-8 | 0.125 | 15,751,193.64 |

| 8-12 | 0.0625 | 18,376,193.64 |

| 12-16 | 0.03124 | 19,688,273.64 |

| 16-20 | 0.01562 | 20,344,313.64 |

| 20-24 | 0.00781 | 20,672,333.64 |

| 24-28 | 0.0039 | 20,836,133.64 |

| 28-32 | 0.00195 | 20,918,033.64 |

| 32-36 | 0.000975 | 20,958,983.64 |

| 36-40 | 0.000488 | 20,979,479.64 |

| 40-44 | 0.000244 | 20,989,727.64 |

| 44-48 | 0.000122 | 20,994,851.64 |

| 48-52 | 0.000061 | 20,997,413.64 |

| 52-56 | 0.0000305 | 20,998,694.64 |

| 56-60 | 0.000016 | 20,999,366.64 |

| 60-64 | 0.0000076 | 20,999,685.84 |

| 64-68 | 0.0000038 | 20,999,845.44 |

| 68-72 | 0.0000019 | 20,999,925.24 |

| 72-76 | 0.00000095 | 20,999,965.14 |

| 76-80 | 0.00000045 | 20,999,984.04 |

| 80-84 | 0.0000002 | 20,999,992.44 |

| 84-88 | 0.0000001 | 20,999,996.64 |

| 88-92 | 0.00000005 | 20,999,998.74 |

| 92-96 | 0.00000002 | 20,999,999.58 |

| 96-100 | 0.00000001 | 21,000,000.00 |

| >100 | 0 | 21,000,000.00 |

The table above can be visualized in the graph chart below.

With current chain configuration, after the block reward reaches 0 (at year 100), validators can still be incentivized by setting minFeePerByte to 0, which means transaction fees will be paid to validators. This can be achieved through on-chain configuration modification proposals, if the fee module on the Klayr SDK implements the governance module; otherwise, it would require a hard fork. For more details, visit the Governance Section.

Consensus

SWX is used to secure the Swaptoshi protocol network through staking on a Proof-of-Stake (PoS) consensus mechanism.

Swaptoshi network will adopt the Klayr SDK PoS consensus configuration with certain modifications, including a block time of 3 seconds and a minWeightStandby configuration of 10 SWX.

Rewards will start at 0.25 SWX per block and will be halved every 42,000,000 blocks (approximately every 4 years). The reward distribution will commence after a 201559 block (approximately 7-day) initialization phase, and the final reward will be issued 100 years thereafter.

Liquid Staking

For every SWX that is staked, users will receive a 1:1 equivalent in liquid SWL, which can be utilised within the Swaptoshi protocol. This ensures the network remains secure while maintaining liquidity.

To unstake, users must hold a 1:1 equivalent of SWL in their wallet.

Swap Fee & NFT Positions

Every liquidity provider that supplies liquidity will earn a fee from each swap transaction.

Liquidity positions will be represented by NFTs (LIP-0052). Since liquidity positions are represented in NFT form, they can be traded and ownership can be transferred. Only the owners of these NFTs can claim rewards from swap fees for each NFT position.

Fee Conversion

SWX is used to pay transaction fees within the network.

However, Swaptoshi implements the feeConversion module, which allows users to pay transaction fees without needing to hold SWX initially, enhancing the overall user experience for starting swaps.

The activation condition for the feeConversion module is that, the token being swapped must have a liquidity pool against either SWX or SWL, and liquidity must be available.

For example, if a user wants to swap KLY for PEPX, and there exists a KLY/SWX or KLY/SWL liquidity pool, the user does not need to hold SWX tokens. In this case, KLY will be automatically converted into SWX when the swap command is executed on-chain.

This incentivizes token creators to establish liquidity pools for SWX or SWL, which is expected to enhance the value of both SWX and SWL.

Governance

SWX is also used for voting on the DAO treasury.

Treasury Address is klyr49epb3jdyqmnfyrz7jdc5ws3rmyuqzje4c4jb, which obtained by SHA256(b"GovernanceTreasuryAccount")[:20], as outlined on LIP-0074

The treasury will acquire SWX as well as other tokens from the following activities:

10%of each block reward will be transferred to the treasury address.- Fees from each transaction will not be burned, but will be sent to the treasury. This also ensuring that the total supply of 21 million remains constant.

- Every swap fee received by liquidity providers will be subject to a

10%deduction, which will be transferred to the treasury

As outlined in Governance Section, these behaviours are expected to be configurable and can be decided through on-chain DAO proposals, which are voted on by SWX holders.